how to change how much taxes are taken out of paycheck

This total represents approximately how much total federal tax will be withheld from your paycheck for the year. Its harder to make that threshold if you file jointly as this requires you to combine your income with your spouses.

Taxes On Paycheck Flash Sales 55 Off Www Ingeniovirtual Com

Reduce the number on line 4 a or 4.

. This calculator will calculate your tax bill for you. To find out your exact tax amount enter the amount of your gross pay and then select a federal income tax calculator. For a single filer the first 9875 you earn is taxed at 10.

Next add in how much federal income tax has already been withheld year to date. Get ready today to. Figure out your new withholding on through the IRSs tax withholding estimator.

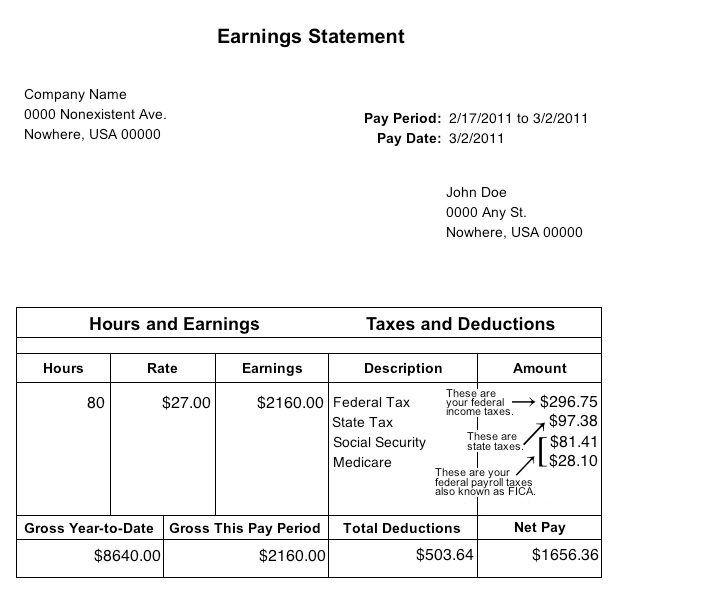

For 2018 you can still deduct qualified medical expenses that exceed 75 of your adjusted gross income. If you increase your contributions your paychecks will get smaller. Heres a breakdown of the different paycheck taxes and why they sometimes change.

The new withholding for taxes should take place moving forward. The average taxpayer gets a tax refund of about 2800 every year. For example say you want your refund to be 240 and you get paid twice per month.

Its important to note that there are limits to the pre-tax contribution amounts. If too little is being taken increase the withheld amount. Increase the number of dependents.

Submit your new W-4 to your payroll department. Employers use the W-4 to calculate certain payroll taxes and transfer taxes to the IRS and the state on behalf of employees. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes.

Federal income tax thresholds vary from year to year but in general they range from 10 to 37. For Medicare you will owe 09 of your gross wages. Fill Out a New Form W-4.

To adjust your withholding is a pretty simple process. Take the result and add that number to what the calculator told you to put on line 4 c. Give it to your employers human resources or payroll department and theyll make the necessary adjustments.

You can ask your employer for a copy of this form or you can obtain it. The employer portion is 15 percent and the employee share is six percent. You will owe the rest of the tax which is 153 percent.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. Your employer is required to have you fill out a W-4 form when you start work in order to determine the amount of estimated income tax to withhold from your paycheck. Assuming your tax situation matches exactly with what you put in the calculator.

How to Change How Much Taxes Are Taken Out of Paycheck. For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions. This is because they have too much tax withheld from their paychecks.

If you want less in taxes taken out of your paychecks perhaps leading to having to pay a tax bill when you file your annual return heres how you might adjust your W-4. If too much tax is being taken from your paycheck decrease the withholding on your W-4. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

To get this figure youll need to add how much federal income tax has been taken out this year. You should get the refund you want. Get a new W-4 Form and fill it out completely based on your situation.

You must pay federal income tax when your earnings exceed a certain amount. You need to submit a new W-4 to your employer giving the new amounts to be withheld. This is a rough estimate of what your federal tax will be for the whole year.

In order to adjust your tax withholding you will have to complete a new W-4 form with your employer. The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their pay. Beginning in 2019 you will only be able to deduct the amount of unreimbursed allowable medical care expenses that.

Take 240 and divide it by 24. For example you can have an extra 25 in taxes taken out of each paycheck by writing that amount on the corresponding line of your W-4. Only the very last 1475 you earned would be taxed at.

Take your new withholding amount per pay period and multiply it by the number of pay periods remaining in the year. In effect taxpayers who get refunds are giving the IRS an interest-free loan of their money. For 2022 the limit for 401 k plans is 20500.

IR-2019-178 Get Ready for Taxes. Once youve used the Tax Withholding Estimator tool you can use the results of the calculator to fill out a new Form W-4. If you prefer owing the IRS at years end rather than receiving a refund you may need to complete a new W-4 form to change the tax that your employer withholds from your remaining paychecks for the current tax year.

To figure out the yearly amount take the new amount withheld per pay period and multiply it by the number of remaining pay periods. One option that you have is to ask your employer to withhold an additional dollar amount from your paychecks. A Form W-4 officially titled Employee Source Deduction Certificate is an IRS form that employees use to tell employers the amount of tax to withhold on each paycheck.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Taxpayers who use the calculator and determine that they need to change their withholding must fill out a new Form W-4 Employees Withholding Allowance Certificate. Federal Tax Withholding Fed Tax FT or FWT Your employer will use information you provided on your new Form W-4 as well as the amount of your taxable income and how frequently you are paid in order to determine how much federal income tax withholding FITW to withhold from each paycheck.

Taxpayers can use the updated Withholding Calculator on IRSgov to do a quick paycheck checkup to check that theyre not having too little or too much tax withheld at work. Federal law requires employers to withhold taxes for employees. But before you complete a new W-4 use the IRS Tax Withholding Estimator to calculate to tax you may owe at years end or the refund you may.

If you find yourself always paying a big tax bill in April take a look at your W-4.

Taxes On Paycheck Flash Sales 55 Off Www Ingeniovirtual Com

Taxes On Paycheck Flash Sales 55 Off Www Ingeniovirtual Com

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Taxes On Paycheck Flash Sales 55 Off Www Ingeniovirtual Com

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

How To Fill Out Form W 4 W4 Withholding Allowances Taxact

Paycheck Taxes Federal State Local Withholding H R Block

How To Calculate Taxes On Paycheck Factory Sale 57 Off Www Ingeniovirtual Com

Taxes On Paycheck Flash Sales 55 Off Www Ingeniovirtual Com

Anatomy Of A Paycheck What To Deduct And Why

Paycheck Calculator Online For Per Pay Period Create W 4

Irs New Tax Withholding Tables

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age